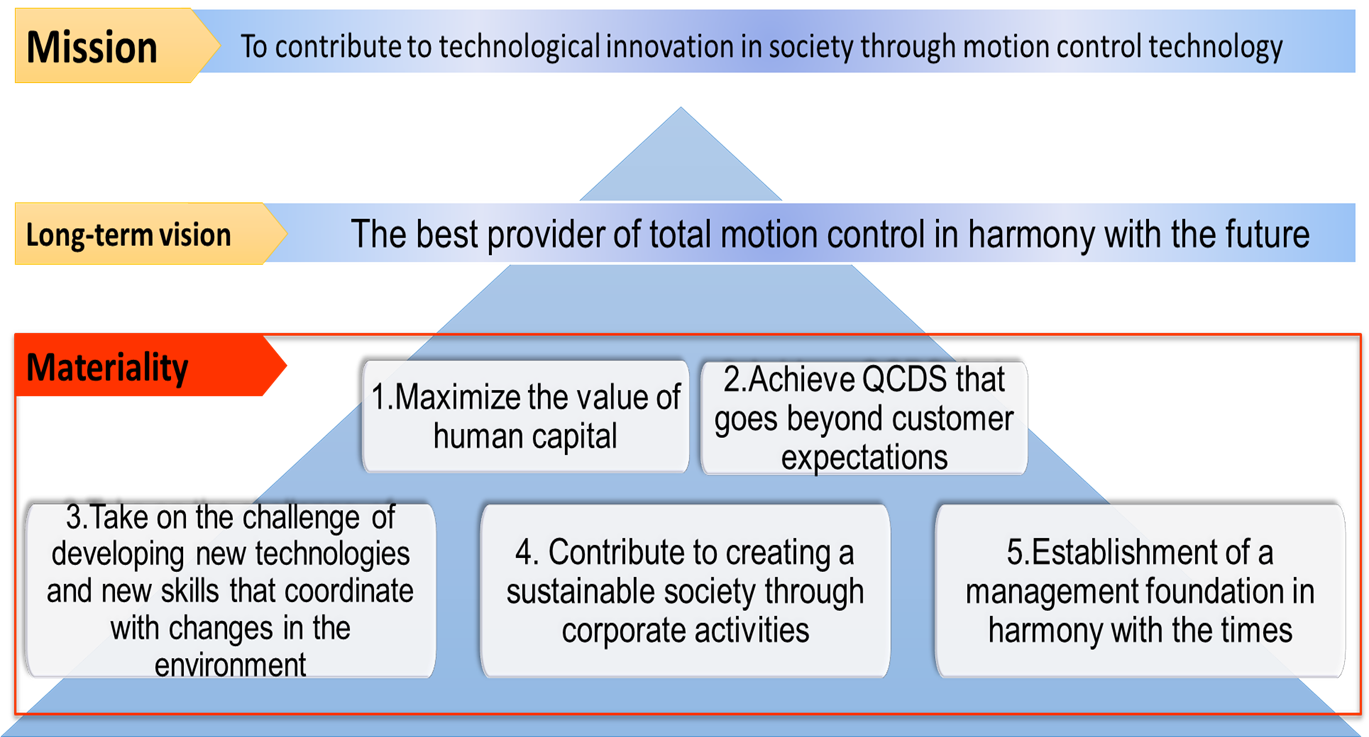

The Group promotes its unwavering mission of contributing to social and technological innovation through motion control technology. The market for mechatronics and precision speed reducers, in which we participate, is contributing greatly to the emerging social and technological innovation, including electrification of vehicles and surgical robots, and such demand is expected to continue to expand. At the same time, with the acceleration of automation, demand for collaborative robots in addition to a new market for “humanoid robots,” is expected to increase amid the worldwide labor shortage. To properly capture these growth opportunities, the Group aims to further strengthen its business foundation by newly formulating a new medium-term management plan (fiscal years 2024-2026). We also reevaluated materialities considering them as important issues to achieve our vision.

Management Principles

1. Respect for the Individual

2. A Meaningful Company

3. Coexistence and Co-prosperity

4. Contribution to Society

Basic Policy of Sustainability

Basic Policy of Sustainability ( approved by our Board of Directors on March 25, 2022)

As a technology and skills-based organization in pursuit of Total Motion Control, the HDSI Group aims to enhance corporate value and realize a sustainable society by contributing to technological innovation for the betterment of society. We intend to achieve these goals based on our management philosophy comprising four pillars: Respect for the individuals, be a meaningful company, coexistence and co-prosperity, and contribution to society.

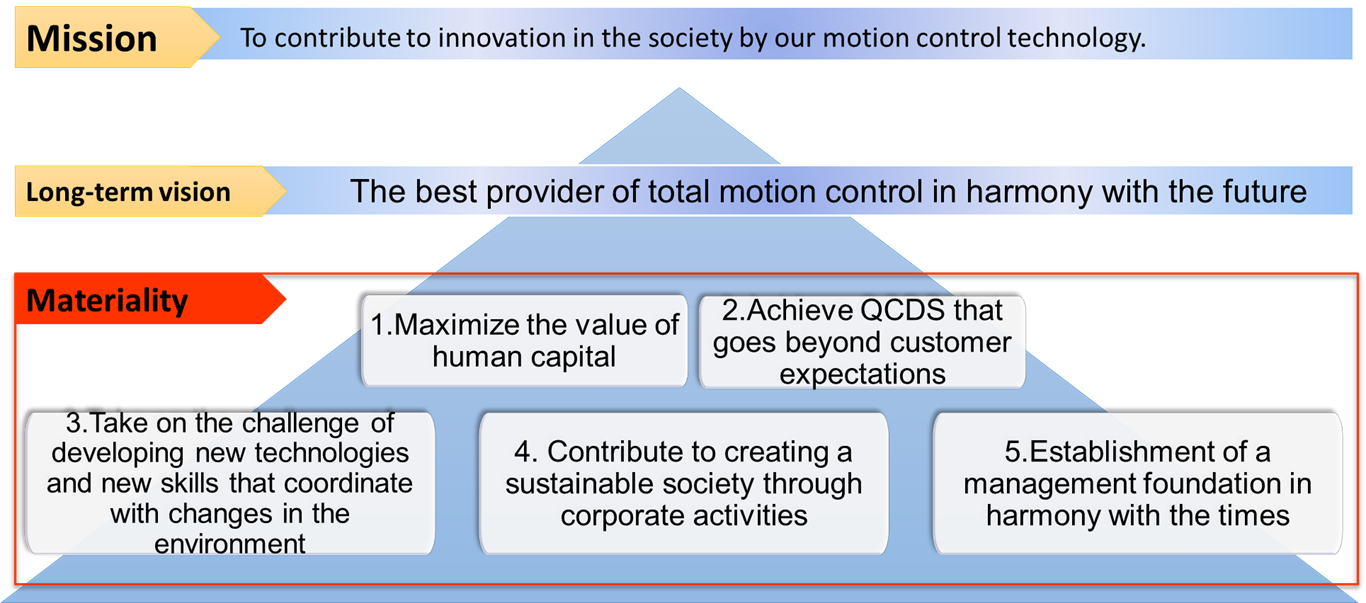

Mission/Long-term vision/Materiality

Medium-Term Management Plan for Fiscal Years 2024–2026

Basic Policy

Considering value creation and transformation to be the two key factors to achieve our mission and value, the Group strives for solving issues to be addressed according to its basic policies set on three pillars: 1) what we are striving to do, 2) what is necessary for that, and 3) sustainability.

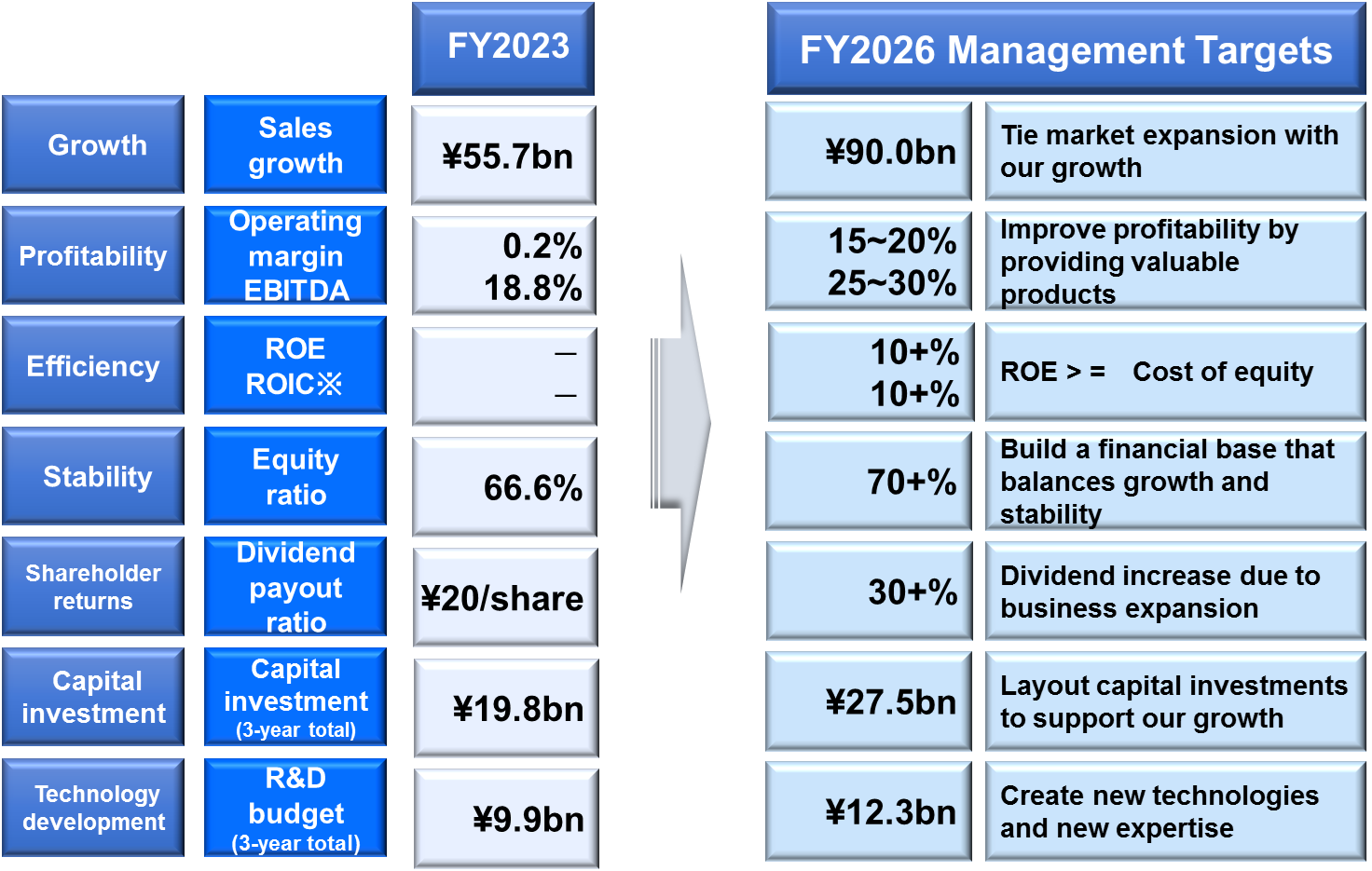

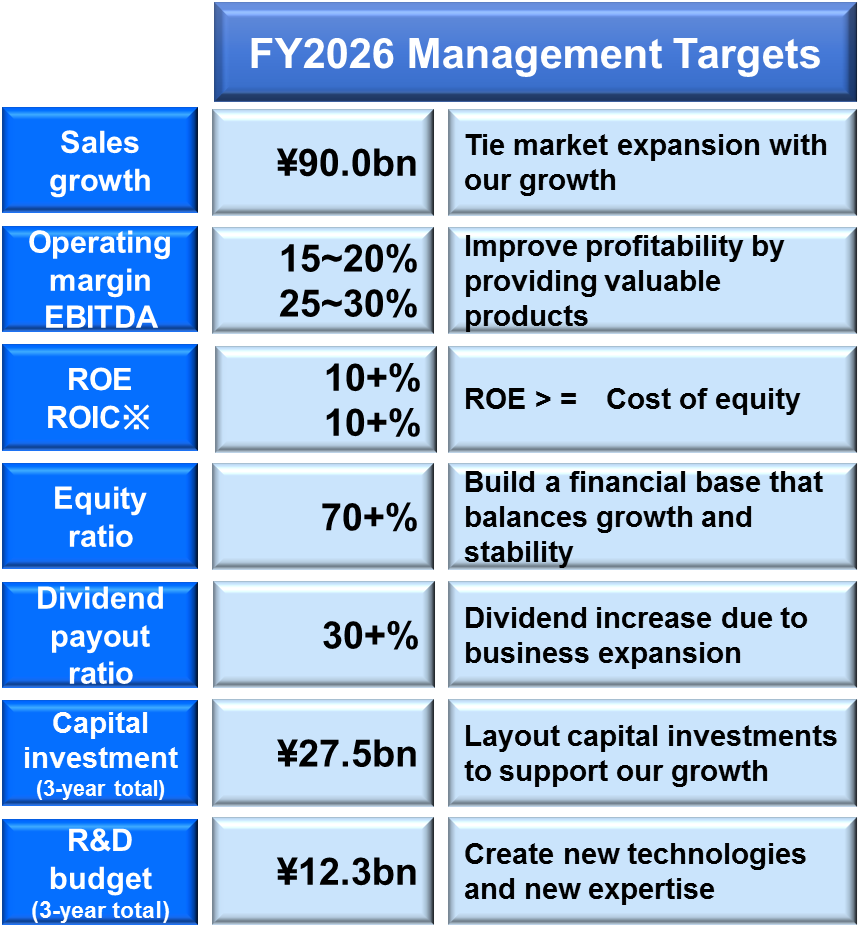

Target Management Indicators

Towards realizing sustainable growth and long-term enhancement of corporate value, the Group has newly added ratio of operating profit to net sales of 15% or more and a ratio of net sales to EBITDA of 25% or more as a “cash generation ability indicator” for net sales as indicators in the medium-term management plan (fiscal years 2024–2026) as the Group’s important management indicators. As an important financial indicator, in addition to return on equity (ROE), ROIC is a new indicator. Assuming that a comparable capital cost (WACC) is approximately at the 9% level, setting a target of return on equity (ROE) and ROIC at 10% or more, we aim to improve return on capital through conducting management aware of the operational efficiency of invested capital.

Management Targets for FY2026 (Final Year of Medium-Term Plan)

Mid-Term Management Plan for FY2024-FY2026_